A widely popular way to give, this plan allows a donor to decide how much to put into the trust and chooses to receive a fixed percentage of the fair market value of these assets, this value is re-evaluated annually for the life of the donor. At the donor’s passing the trusts assets go to the school.

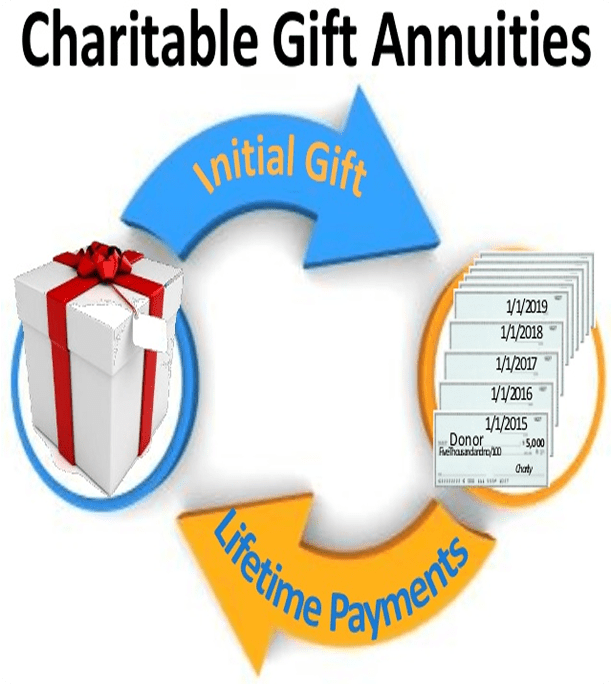

This form of gift is actually a contract between the donor and the charity wherein the donor transfers assets, (cash, securities or real property), in exchange for the annual fixed dollar payment for the life of one or two stated beneficiaries.

Usually the simplest kind of planned gift. A bequest is a provision in a donor’s will and testament which names a charity as a beneficiary of a portion of the donor’s estate. The donor’s estate receives a charitable deduction for the total amount given to the charity with no limit.

If your goal is to provide an inheritance for your children, but you would also like to make a significant charitable gift through your estate this form of gift may be right for you. Once the trust is set up the assets are invested and generate annual income to the school for a specified number of years. At the end of this time the trust is returned to the donor. This method generates a substantial amount of income, provides the donor an immediate tax deduction and can save on estate taxes.

To make a donation online please select one of the contribution designations below. (To clarify where your donation will be going, please read the “Classification of Contributions to St. Augustine High School” section below the contribution designations. Thank you in advance for your contribution to St. Augustine High School and it’s Mission.)

Classifications of Contributions to St. Augustine High School

St. Augustine High School is a 501(c)(3) not for profit corporation which allows for it to accept tax deductible gifts from donors in support of the educational mission of the school. As such, the school has a fiduciary responsibility to utilize contributions in a manner consistent with a donor’s intent.

In accordance with the generally accepted accounting principles used by the school’s independent auditors, contributions are classified in one of two categories: unrestricted or permanently restricted. Classification of contributions is based on the level of donor restriction for use.

Unrestricted contributions are given unconditionally. The school has immediate use of these contributions and their use is determined by the school based on its areas of greatest need.

Contributions with donor restrictions requiring the principal gift to be held in perpetuity are classified as permanently restricted and commonly referred to as “endowment funds”. The school pools these contributions into a portfolio of investments and the income earned from such assets is generally restricted to the purpose designated by the donor. The school’s Finance Committee regularly reviews the performance of the portfolio for meeting the school’s investment goals of growth and income and a portion of earnings is annually transferred to the operational fund of the school. The majority the school’s endowment contributions are used to fund student need-based tuition grants.

For more information contact the Advancement Office: 619.764.5541